Angola: persistent FX pressures, and likely softer GDP growth

Medium-term outlook: growth softening due to subdued investment and further FX pressures

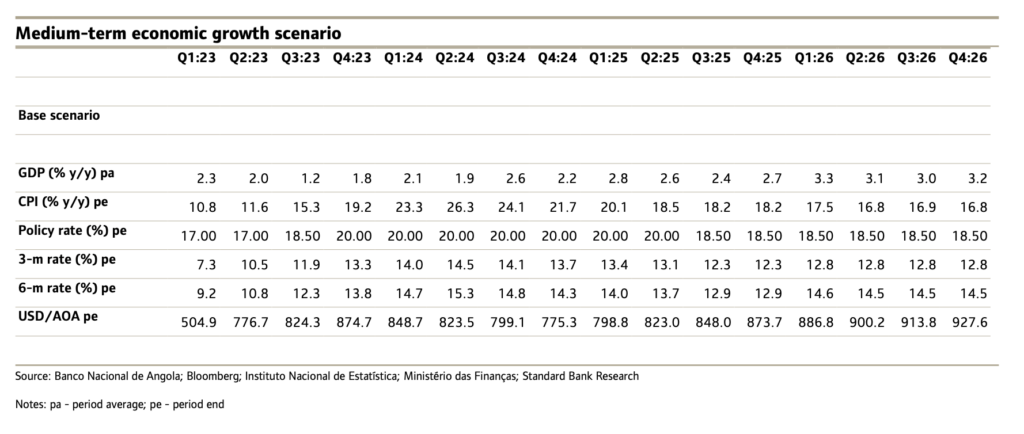

We retain our Jan AMR edition growth forecast of 1.8% y/y for 2023, a deceleration from 3% y/y in 2022, as we foresee subdued investment and maturing oil fields reducing oil and gas (O&G) output by 3.1% y/y, to 1.183 m bpd.

Non-oil growth slows to 3.6% y/y this year, from 4% y/y last year, as softer oil prices and higher external debt service mean reduced FX liquidity, which likely constrains non-oil growth.

However, in 2024, some oil price recovery, as well as 0.9% y/y increase in O&G output, to 1.194 m bpd, combined with 2.6% y/y non-oil growth, should lift GDP growth to 2.2% y/y.

Subdued O&G output has meant that GDP growth has been more reliant on the non-oil economy. Indeed, over the past decade, the non-oil sector contribution rose to 74% of GDP, from 63%. However, there is still a heavy reliance on the oil sector (which accounts for 95% of exports and 50% of fiscal revenue).

O&G provides most of the FX liquidity required for Angola’s economy to function; it remains heavily reliant on imports.

Oil prices, trading at near the Angola 2023 budget assumption of USD75/bbl at the time of writing, are down by 26%, from an average of USD102/bbl in 2022. This, combined with softer oil output, diminishes exports as well as FX liquidity. Still, oil prices at near budget levels might have remained supportive for growth, were it not for higher external debt service this year.

Angola faces higher interest rates globally as well as the resumption of principal debt repayment on some Chinese loans (which had benefited from a moratorium since the pandemic).

External debt principal repayment is up by 78% y/y this year, to AOA3.8trn (USD7.5bn at budget time USD/AOA pair of 504), with interest up by 31% y/y, to USD2.6bn. This saw FX sales from the Treasury down to near zero in Q2:23, from USD442m per month in 2022, further crimping FX liquidity.

The BNA had allowed the kwanza to depreciate by over 40% y/y at the time of writing, when it was trading at 727.7 to the US dollar; further weakness is expected.

This year, a weaker kwanza and the fuel subsidy reform will fuel inflation. Therefore, monetary policy tightening is now expected, which should lower domestic expenditure (GDE) and growth. Next year, net exports should turn positive as exports likely grow faster than imports, supporting some growth recovery. However, due to subdued investment, growth remains below 3% y/y population growth for most our forecast period.