Botswana: disinflation, and growth normalizing in 2023

Medium-term outlook: growth moderation not as severe as expected

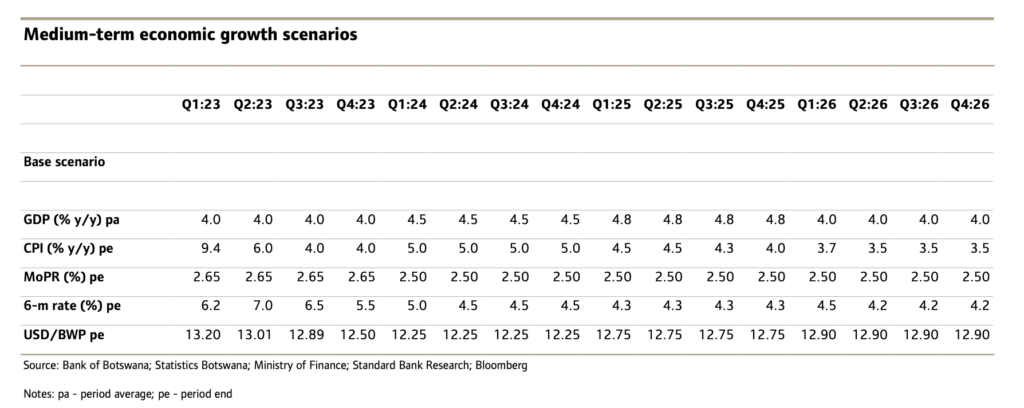

We still expect Botswana’s real GDP growth in 2023 to moderate but have nevertheless increased our growth estimate to 4.0% y/y, from 2.3% y/y previously, as we now foresee an improved growth outlook for household consumption, construction as well as election spending.

Growth moderating will be driven primarily by a high base effect for diamond production as well as prices having an impact on export earnings, relative to 2022. Lower electricity production from South Africa and Zambia also poses downside risks to growth.

That’s not to say that in absolute terms the diamond industry will not grow. Despite the early dip in Jan, De Beers is optimistic about a positive recovery in the medium term, and in 1Q:23 posted a 12% y/y increase, to 6.9 million carats production, in Botswana.

Pula earnings from rough and polished diamond exports in Jan 23 were down 32% y/y but picked up significantly in Mar and Apr. Year to Apr 23, rough diamond export earnings were 7% y/y, compared to the same period in 2022.

In the medium term, higher copper prices from 2024 are expected to boost mining activity and reduce Botswana’s dependence on diamonds.

The Motheo copper mine, owned by Sandfire Resources, commenced operations in May and is targeting an initial production capacity of 3.2 million tons per year (Mt/y). Additionally, Khoemacau, which may have reached full capacity by end 2022, is expected to further stimulate GDP growth.

Sluggish government spending, amidst efforts to rein in public sector expenditure (the Workforce Planning Strategy) and strengthen oversight of state-owned enterprises, may impel softer growth in the medium term but, in the short term, election spending in the fiscal year 2023/24 should boost growth.

Private consumption may also support overall growth, underpinned by subdued inflation and stable unemployment rates. Gross fixed capital formation (GFCF) is also anticipated to pick up, driven by construction, and a return to normal investment conditions as high inflation eases.

Overall GDP growth during NDP 11 fell short of projections, mainly due to the Covid-19-induced recession in 2020 and the impact of the Russia-Ukraine conflict. Actual growth averaged 2.7% per year, below the projected 4.2% average. The unemployment rate increased from 17.5% in 2015, to 26.0% in 2021, partly due to the pandemic. Still, there was a slight decline in the unemployment rate, to 25.4% in Q4:22.