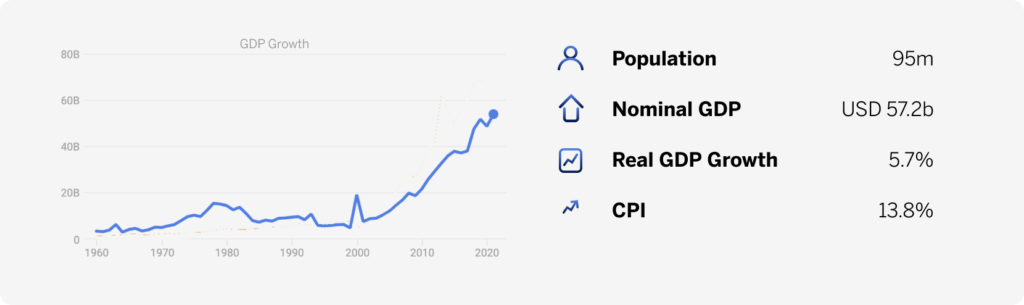

We expect GDP growth of 5.5% y/y in 2022 and 5.8% y/y in 2023. We expect that the C/A surplus to reach 0.7% of GDP in 2022 and 1.7% of GDP in 2023. We see the pair USD/MWK around 1 987.8 at year-end.

GDP growth – non-extractive sector still recovering

We revise our GDP growth forecast to 5.5% y/y for 2022 and 5.8% y/y for 2023, from 5.0% and 5.5% y/y respectively. The extractive sector seems set to drive growth, with the nonextractive sector still in recovery. Preliminary data puts growth at 5.7% y/y for 2021, supported by favourable base effects following growth of a mere 1.7% y/y in 2020.

Balance of payments – strong export performance

We expect DRC’s current account surplus to reach 0.7% of GDP at end 2022 and 1.7 % of GDP at end 2023. We had expected the current account to post a surplus in 2021, but it is estimated to have posted a deficit of just under 1% of GDP. That said, DRC’s terms of trade have strengthened significantly over the past 2-y, largely as a function of elevated export receipts from the mining sector. However, this should be somewhat offset by recovering import growth, combined with a higher fuel import bill.

Monetary policy – hiking cycle imminent

We expect the BCC’s MPC to increase the policy rate by 200 bps within the next 6-m. The MPC adjusted the policy rate lower by 200 bps in mid-2021, leaving the rate unchanged at 8.5% since then due to underlying inflation being stable.

FX outlook – USD/CDF holds steady

We forecast the USD/CDF pair to reach 2,013 by end 2022 and 2,053 by end 2023. Strong export performance should continue supporting the currency’s stability, as would improvements in onshore FX liquidity conditions.

Download the annual indicators.