Ghana: timely external debt restructuring pivotal

Medium-term outlook: underpinned by mining sector recovery

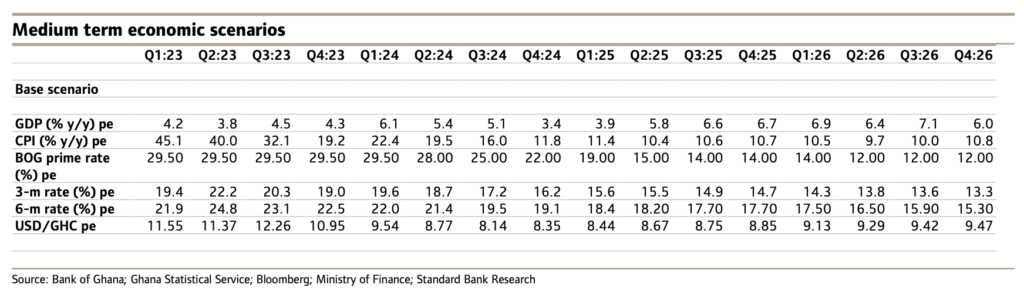

We now upgrade our 2023 GDP growth forecast to 4.2% y/y, from 3.8% y/y. However, our 2024 growth forecast now is 5.0% y/y, from 6.4% y/y previously.

GDP growth reached 3.6% y/y in 2022, exceeding our forecast of 2.4% y/y. Growth was buoyed by a notable recovery in the mining sector, as we had anticipated. The gold sub-sector expanded by 32.3% y/y, from a contraction of 31.2% y/y in 2021 and 12.2% y/y in 2020.

The recovery in gold production has been due primarily to a revival in activity at the Obuasi and Bibiani mines. Before 2022, the Bibiani mine hadn’t produced gold for 7-y.

Robust gold production should continue over the coming year, underpinning both net exports and GDP growth. In addition to downwardly revising withholding tax rates for unrefined gold, which has supported small-scale mines, gold production should be spurred by the imminent completion of three new large mines (Cardinal Resources, Azumah Resources and Newmont’s Ahafo North project).

Furthermore, the first disbursement under the USD3.0bn IMF ECF programme was approved in May 23, triggering an immediate release of USD600m in funding. This may prove a crucial step in restoring macroeconomic stability and boosting economic activity.

Debt sustainability challenges, that were compounded by difficulties in obtaining external funding, have reduced development expenditure, weighing on growth over the past year. Thus, should the government make further progress on external debt restructuring in H2:23 as well as unlock other multilateral funding, capital expenditure may recover and thereby underpin growth.

However, should external debt-restructuring negotiations prove protracted, the next IMF disbursement of USD600m, expected after the Nov 23 review, may also be delayed. This could disrupt expected funding from other multilaterals, such as the World Bank, which would impinge on growth because inflation may then remain elevated and the GHS under pressure.

Delays in external debt restructuring also carry the risk of further deficit monetisation, which would further fuel inflation as well as drag private consumption expenditure lower.