Kenya: debt restructuring unlikely

Medium-term outlook: agricultural sector may still recover

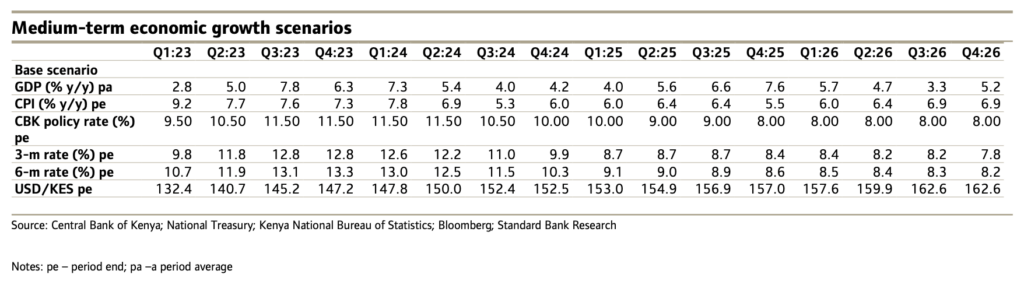

In 2022, GDP growth slowed to 4.8% y/y, matching our forecast. We now retain our GDP forecast at 5.5% – 5.8% y/y for 2023.

Per our Jan AMR edition, a recovery in the agricultural sector would be pivotal for GDP growth recovering this year. However, the long rains season (which began in Mar after a slight delay) proved inadequate across Kenya’s key food-growing counties.

However, the Kenya Meteorological Department (KMD) has a 60% probability of El Niño rains (May-Jul 23), rising to 60- 70% (Jun-Aug 23), then to 70-80% (Jul-Oct 23).

During El Niño events over the past 5-y, particularly in 2019, the initial impact of heavy rainfall was negative for the agrarian sub-sector. However, these rains, if not destructive, may also boost private consumption, through declining food prices.

Notably, there are persistent downside risks to economic growth for 2023/24. Firstly, poor debt sustainability has seen the government trim development expenditure. Sharply higher public investment in infrastructure had largely underpinned GDP growth over the last decade. Now, the government has slashed expenditure by around KES300b in the FY2022/23 supplementary budget, with capital expenditure comprising the lion’s share of the cuts. Therefore, funding constraints will likely subdue development expenditure absorption rates for FY2023/24.

Furthermore, most of the proposals in the Finance Bill 2023 (that could increase both the cost of doing business and cost of living), may stunt growth in private investment and personal consumption, thereby weighing on growth.

The opposition has warned of protests resuming, following the passing of the Finance Bill. Private sector activity waned earlier in H1:23, particularly when the opposition staged protests for weeks (on Mondays and Thursdays).

Nevertheless, unwinding base effects should favour GDP growth for 2023. However, impending bills may still increase banking sector NPLs and stunt private sector credit growth. The last reported stock of impending bills was around KES500-600bn.