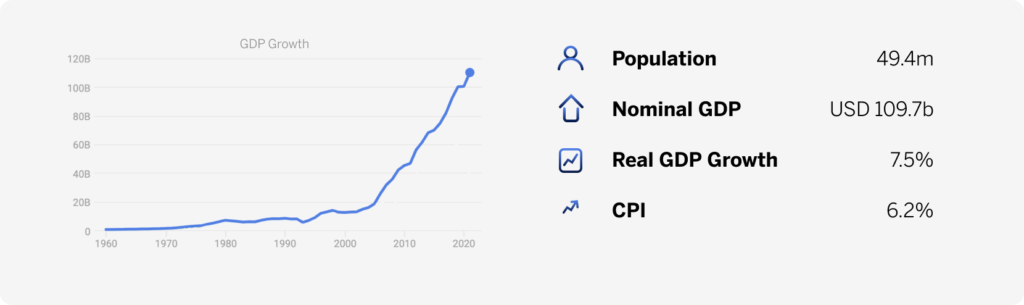

We ease 2022 GDP growth to 3.1% y/y but retain 2023 forecast at 3.5% y/y. We see the C/A deficit as widening to 9.3% of GDP in 2022, then narrowing to 7.7% of GDP in 2023. The USD/NAD pair expected to end the year at 15.00.

GDP growth – mining sector upside

We ease our 2022 GDP growth forecast to 3.1% y/y, from 3.4% y/y previously, but retain our 2023 forecast at 3.5% y/y. Our slightly softer forecast for this year follows the war in Ukraine as well as resultant surging global food and fuel prices which could dampen domestic demand. All sectors are likely to post growth in the near- to medium term, though the secondary industries more slowly so, especially the construction sub-sector which has been in contraction since 2016.

The mining subsector, particularly diamond mining, should underpin growth over the forecast period. The newly launched diamond recovery vessel is estimated to add an additional 500k carats to annual marine mining production (an approximate increase of 45%). Uranium production too should be supported by sufficient water supply to extract high-grade ore. Moreover, the two recent offshore oil discoveries, estimated at 1.5-2.0 billion barrels of light oil, should boost domestic activity in the long term, depending on the timing of the final investment decision (FID).

Balance of payments – C/A deficit widening further

The C/A deficit will likely widen further this year, which may moderate the accretion of FX reserves. We see the C/A deficit as widening to 9.3% of GDP in 2022, then narrowing to 7.7% of GDP in 2023, from an estimate of 9.1% of GDP in 2021. Given the relentless rise in global oil and food prices, the import bill now faces further upside pressure. Petroleum oils topped the list of imported products and grew by 35.9% y/y in 2021. Therefore, the oil import bill could remain high if international prices do. Higher diamond exports may provide some reprieve to the widening trade balance when the newly launched diamond vessel comes online in Q2:22.

However, downside risks here include poor global demand and subdued international diamond prices. In addition, the lockdowns in China may limit demand for commodities such as zinc and copper.

Monetary policy – grappling with food and fuel costs

Following the cumulative 50 bps in rate hikes since Jan, we expect the Bank of Namibia’s MPC to hike the repo by a further 100 bps, to 5.25% by Dec. Then, another 50 bps in 2023. The Ukraine war has exacerbated global inflationary pressures, especially those of food and fuel, causing many central banks, including the South African Reserve Bank (SARB), to upwardly revise the inflation outlook and thus the pace of hiking. Indeed, post the 50 bps hike at the May meeting, the SARB may well hike rates further by 25 bps at each meeting in Q3 this year, with the Bank of Namibia’s MPC following suit to preserve the one-to-one currency link between the NAD and the ZAR.

FX outlook – supportive terms of trade

The 1:1 arrangement linking the NAD to the ZAR seems set. Year-to-date, the terms of trade supported the ZAR. This could continue, with the USD/ZAR pair expected to end the year at 15.00. However, should these relatively stronger terms of trade reverse in H2:22, the rand may lose ground.

The pair is expected to weaken marginally to 15.08 by H1:23, ending 2023 at 15.15. Still, factors that may detract from the rand trajectory would be slowing SA growth and/or inadequate fiscal policy reforms. Further risks include a protracted Ukraine war. Moreover, with imminent Fed interest rates hikes, implying a less favourable EM setting, the ZAR may be vulnerable.